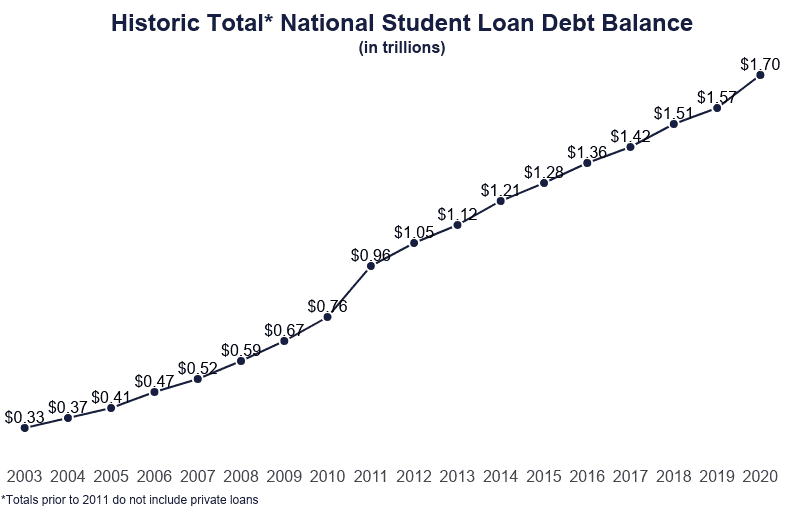

Student loans are an increasingly common problem throughout the country. According to EducationData.org, student loan debt is now the second-highest consumer debt category.

Source: EducationData.org, https://educationdata.org/student-loan-debt-statistics.

If you’re reading this article, you are likely aware of how complicated student loans can be. They come in a wide variety, such as subsidized, unsubsidized, private, parent, and graduate-level loans, to name a few. Since student loans are typically issued each semester and vary by interest rate, a series of several smaller loans often make up the debt as a whole.

Equitable Distribution in Colorado

If student loans weren’t complicated enough, try adding a divorce into the mix. Colorado is an equitable distribution state. Divorce courts will divide marital property (and debts) by deciding what is considered fair and equitable to both parties under the circumstances. Unsurprisingly, the analysis can vary substantially from case to case.

For example, suppose Max and Mia got married. Shortly after, Mia went to graduate school to earn an MBA. Max worked full-time while Mia was in school. Mia borrowed $60,000 in student loans as well. After earning an MBA, Mia began working in a decent-paying job for a start-up company, earning $150,000 per year. If the couple separated immediately after Mia’s graduation, the court might allocate the student loans to Mia as a fair division of the marital debt. Now imagine the couple stayed married for another 15 years and benefited from Mia’s income that whole time. In that case, the court may divide the obligation evenly between both parties. The smaller the benefit Max received from Mia’s educational endeavors, the less likely the court is to divide Mia’s between both parties. Regardless of the scenario, the court will always look to what is fair and equitable under the circumstances.

Marital Debts Versus Separate Debts

However, before a court can decide what is far, it has to classify the property (including assets and liabilities) as either marital or separate. In Colorado, all property or debts acquired during the marriage are generally deemed marital. This means that courts will typically regard student loan debt incurred after the marriage as a shared debt. From there, the court will likely divide any outstanding balance between both parties. In contrast, any student loans incurred before the marriage are likely separate, meaning that the court will probably allocate the obligation exclusively to the borrowing party.

Even for someone who gets married during school, the inquiry is the same. In this situation, those semester-specific, smaller loans become much more important. For example, if Mia started graduate school before getting married and took out loans for the first two semesters, those loans would be Mia’s separate debt. If Mia married Max before the following school year and incurred additional loans for the remaining semesters, the rest of her student loans would be marital.

But what if someone incurs separate student loans before the marriage, additional student loans after the marriage, and then refinances or consolidates the entire student loan debt afterward? In that scenario, the court might find that the premarital loans were commingled with marital loans to become a joint debt. Or, the court may even treat the refinance or consolidation as a new obligation entirely (thus, marital). The takeaway is, unlike a shared credit card or home mortgage, it can be much more subjective and complicated to decide how to divide student loans equitably.

Key Questions

The answers to several primary questions will best assist you in determining how a court might evaluate particular circumstances:

- What is the date of the marriage?

- When was each student loan acquired?

- How were the student loans funds used?

- Who made the student loan payments throughout the marriage?

- Were the loans ever refinanced or consolidated during the marriage?

Concluding Remarks

The bottom line is, any student loans acquired before the marriage are separate. Any student loans acquired during the marriage are marital. For any marital portion of the debt, the divorce court will look at the circumstances as a whole to allocate any outstanding obligations in a manner fair to both parties. Although no divorce is ever easy, a little financial preparation and understanding will go a long way.

Kim Newton is an Associate Attorney at Griffiths Law PC. Kim focuses her practice on both civil litigation and family law. She works in several fields, such as real estate disputes, insurance bad faith, construction defects, commercial litigation, and other business torts.